The Short Answer

Zakat is a charity God obligates Muslims to pay yearly on their money and property. Its payment is made to the poor, vulnerable, and deserving as their divinely established right. The Prophet Muhammad, on him be peace, established Zakat as the third of the five pillars that Islam is built on.

Who Receives Zakat?

Muslims pay Zakat to eight categories of eligible people set by God in the Quran (Surat Al-Tawbah, 9:60):

The Poor (in dire need prevented from asking)

The Indigent (whose destitution drives them to ask)

Those Administering Zakat’s collection and distribution

Those whose hearts are to be reconciled

Those in bondage (slaves to be freed and captives)

The Debt-Ridden

In the Cause of God

The Wayfarer (stranded, displaced, or cut off from resources while traveling)

What Does Zakat Foundation Do with Your Zakat?

The poor and indigent make up the top priorities of Zakat, and these are the people in desperate need that we at the Zakat Foundation focus on distributing your Zakat to. When you pay your Zakat through the Zakat Foundation, you are sending your charitable offering directly to widows and orphans; refugees, the displaced of war, and victims of communal violence; and to families struck by earthquakes, storms, drought, climate change, and other natural disasters.

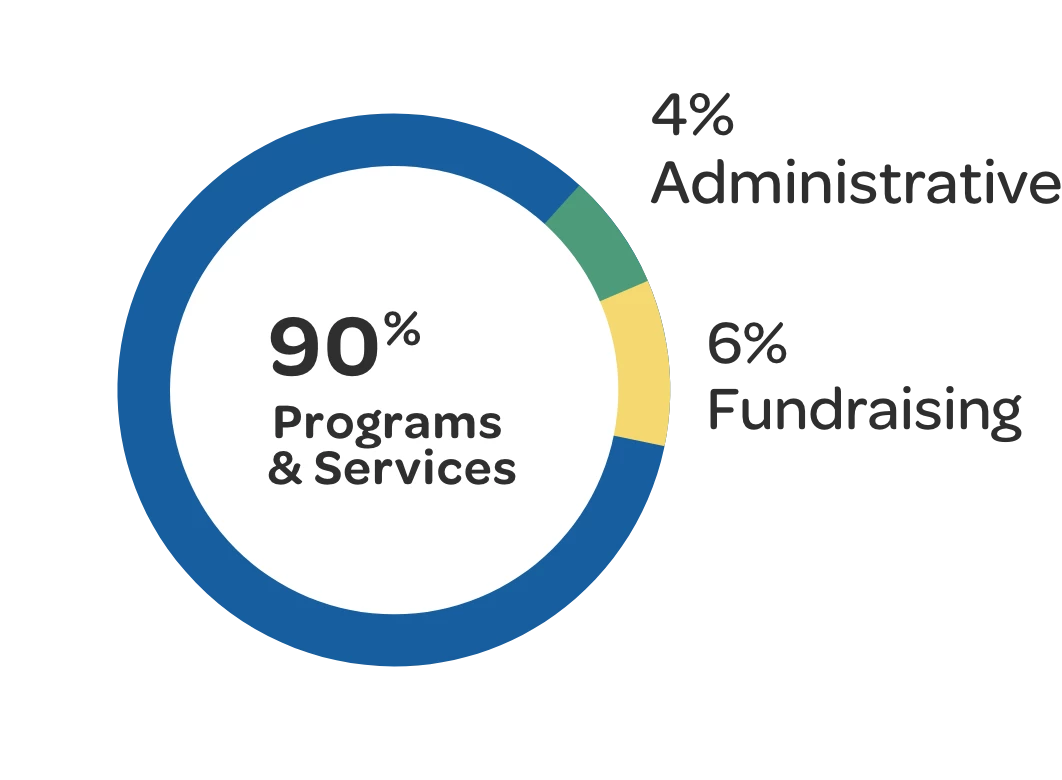

Zakat Foundation uses 100 percent of your Zakat offering for Zakat eligible causes, reaching the most needful people in the world, at home and abroad. Last year, we used 11 cents per dollar on average as designated Zakat administrators working to collect and distribute your Zakat directly to the world’s impoverished, war-ravaged, and disaster-stricken.

What Do You Gain from Paying Zakat?

By paying your Zakat, you fulfill God’s commandment on you, make your Salat (prayers) count, and give thanks to God for His blessings on you. Your Zakat payments cause God’s blessing on you in the form of your money and property to grow — both for you and for those in need whom your Zakat helps. Your accepted Zakat purifies your soul from sin and greed, and it cleanses your wealth from the inevitable taint of worldly corruption.

What Wealth Is Zakat Paid On?

Muslims pay Zakat from the different kinds of their wealth that grow, or that can grow (see What Qualifies Wealth for Zakat?). Most of our wealth is in the form of personal and business wealth, as money, goods, and assets, and includes gold, silver, and precious items used as stores of value; stocks, shares, bonds, retirement accounts and pension instruments (IRAs, Keoughs, deferred income, 401Ks, cash value of insurances, bitcoin, etc.); loans expected repaid, tax refunds, refundable deposits, due salaries or payments; as well as inventory, merchandise, receivables income, investment properties, etc. (see Zakat Calculator).

How Much Is Zakat’s Payment?

Zakat is paid on these wealth forms at 2.5 percent of one’s holdings after a year has passed on them. The year, or hawl, begins when one’s eligible wealth reaches its threshold amount, called nisab, which is equivalent to 3 U.S. ounces, or 85 grams, of gold. (Note: Gold in the market is usually measured in troy ounces, making nisab 2.75 troy oz). Nisab on 9 Mar 2020 was $4,588.30. (see How Is Zakat Calculated on Wealth?)

The Prophet, on him be peace, established the thresholds for the different kinds of qualified wealth, also including crops, livestock, and treasure troves at different Zakat rates (see What Qualifies Wealth for Zakat?)

Zakat Al-Mal and Zakat Al-Fitr

There are two types of Zakat that God and His Messenger, on him be peace, have obliged us to pay: Zakat Al-Mal, or Zakat on Wealth, and Zakat Al-Fitr, the Zakat of Fast-Breaking, for the completion of the fasting month of Ramadan.

Zakat Al-Fitr has no minimum wealth threshold. Everyone pays it, for each member of the household. It can be given to all the eight categories of Zakat Al-Mal listed above, but it too has a special emphasis on the poor and needy, especially to make them happy on the day of the Eid Al-Fitr celebration. It should be paid before the Eid Prayer. Its value equivalency is usually established in the month of Ramadan, which is acceptable to most, but it was traditionally a sa‘, 4 double-handfuls of food, as in dates, barley, raisins, or dried yoghurt — amounts that would fulfill an average household with it.