The Short Answer

No.

Zakat is paid from the different types of wealth (mal, pl. amwal). Eligible wealth types have three basic conditions:

The payer owns it exclusively

It has reached its prophetically established threshold amount (nisab)

An Islamic lunar year (hawl) has passed over it

from the day it first reached its nisab and at its Zakat Due Date (ZDD), regardless of intervening amount fluctuations (Hanafi School of Law)

from the day of first nisab, and sustained at that minimum threshold amount or above (for the other major schools of Islamic Law)

These conditions apply regardless of one’s personal debt (see Is Zakat Due on All Wealth).

An Overview

Muslims pay Zakat as an obligatory alms out of their existing, growing, or growth-capable wealth itself that the Prophet, on him be peace, specified Zakat as due from.

One’s debts are an independent, personal financial obligation (see Can Zakat Be Used to Pay Debt?).

Zakat Not Limited by Debt

The Quran and the Sunnah, that is, divine Revelation (wahy), affix Zakat Al-Mal, the Obligatory Alms of Wealth, as its name says, as an obligation upon wealth types. They do not directly limit this hybrid “rite of worship-cum-financial duty” by one’s indebtedness to others.

THE QURAN: Allah enjoined his Prophet, on him be peace, and by implication those who would follow him in belief: Take from their wealth a ‘charitable offering’ to cleanse them and purify them thereby (Surat Al-Tawbah, 9:103). ‘Charitable Offering’ translates the Arabic word ‘sadaqah.’ In the Quran, ‘sadaqah’ is almost always synonymous with Zakat, the annual obligatory alms. The pronoun ‘their’ refers to all Muslims (see What is the Difference Between Zakat and Sadaqah?).

THE SUNNAH: The Prophet, on him be peace, sent his Companion Mu’adh ibn Jabal, God be pleased with him, as his Zakat collector (musaddiq) to Yemen, with the instruction: “Tell them that Allah has obligated Zakat from their wealth” (Bukhari).

The Prophet, on him be peace, established Zakat’s specifics as God imparted them to him (The Quran generally enjoins principles and commandments, which Allah’s Messenger, on him be peace, specifies). This includes:

The wealth-types that qualify for Zakat

The amounts of each wealth-type exempt from Zakat

The rate at which Zakat payers must pay out of each wealth-type

(See What Requirements Qualify Wealth for Zakat?)

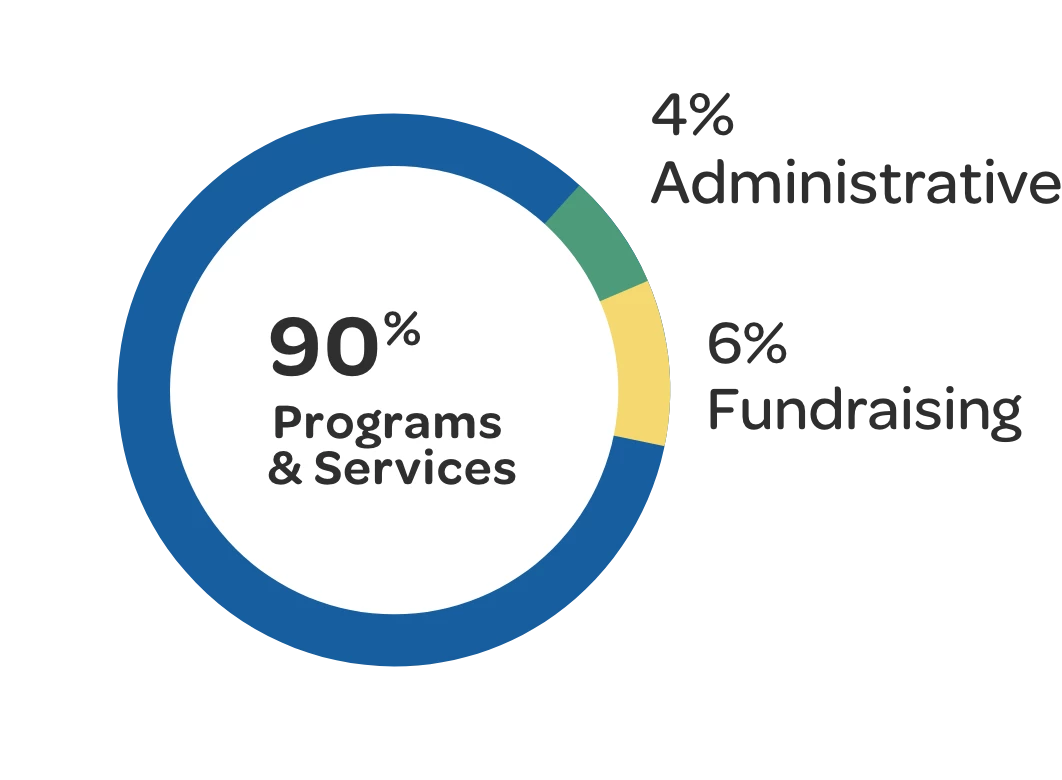

Based on this, when any type of one’s “Zakatable” wealth reaches its specified threshold of Zakat payment (nisab), one must pay Zakat from it at its set rate on its Zakat Due Date (zdd) (see Nisab and Zakat Calculation in a Nutshell). The most common rate on Zakat wealth is 2.5 percent.

Why do student loans not count as debt in Zakat calculation?

One pays Zakat “out of” his or her eligible kind of wealth. Zakat on wealth paid from that wealth is a central concept and explains why scholars prohibit deducting student debt in one’s Zakat calculation, in general.

In brief, debts are of two types: (1) debts to God (like owed Zakat, expiations for missed worship (fidya), and penalties for violations (kaffarah); and (2) debts to people (which can include Zakat, as well).

Student loans are a debt – not against existing wealth – but against anticipated future earnings that the loan was given against the debtor realizing through his or her education.

The contracted course of a student loan’s payment neither diminishes one’s wealth holdings nor is it an obligation against one’s wealth owed as an immediate, demandable collection payment, or as presently due debt. Student debt does not come out of a wealth type or property one currently possesses.

Is any part of student loan debt deductible in calculating Zakat?

The overwhelming position of scholars is that one may deduct from one’s Zakat calculation any payments immediately due at the ZDD. This means that if one has a student loan payment due at or near the time his or her Zakat comes due, one may deduct that payment amount from wealth holdings in calculating one’s Zakat. Typically, payments come due monthly. If that payment will subtract from one’s wealth holdings as this amount will total at the time of the ZDD, one may deduct that particular payment amount in calculating his or her Zakatable wealth and payment.

So one calculates his her personal wealth, minus living expenses (along with one’s other current “essential” living expenses of food, clothing, utility, transportation, insurance, medical payments, etc.), and, if it reaches the minimum threshold (nisab), pays the 2.5 percent Zakat rate for this category on time at its due date. (Other types of wealth – business, agricultural produce, livestock, troves – are calculated independently and paid at their prophetically determined rates and times.)

One is cautioned with student loan payments, as with mortgage payments, that long-term debts do not pre-empt Zakat, which is also a position of Abu Hanifah. So, the opinion of some that one may calculate a year’s payments for a loan in advance and deduct that from current Zakat calculation is not soundly based (see Can Home Mortgages Be Deducted from Zakat as Debt?).

An example of student loan payment deduction from Zakat?

Maryam’s student loan payment of $500 (on a $50,000 outstanding student loan) is due in the month of her zdd for the category of personal wealth.

After expenses, she has $5,000 (in cash on hand, bank accounts, gold and other precious metals and gems, stocks, shares, bonds, retirement accounts, and loans (from this Zakat year, she expects to be paid back), tax and other refunds, and salary and payments due her).

She deducts the $500 due student loan payment from her $5,000 in total Zakatable personal wealth, leaving her $4,500. Maryam checks the current price of gold per gram, which is $55.27. She multiplies $55.27 by 85 grams to find the current value of nisab for personal wealth at $4,697.95. She is under the nisab threshold for Zakat on personal wealth. She does not have to pay Zakat.

What is the formula for calculating Zakat?

Zakat Foundation of America has provided an online Zakat Calculator to help Muslims easily and accurately calculate and pay their Zakat (go to Zakat Calculator).

Here is the overall formula for Zakat calculation:

Sum (personal wealth + business wealth) x .025 – (necessary due debt) – (advanced zakat payment)

= Due Zakat